Intro to bridges

Blockchain technology has been steadily gaining traction over the past few years as a secure, decentralized way to manage digital assets. However, one of the biggest challenges in the blockchain space is interoperability - the ability of different blockchains to communicate with each other. This is where blockchain bridges come in.

Blockchain bridges are mechanisms that allow different blockchains to communicate with each other and share information. These bridges act as connectors between different blockchain networks, allowing users to transfer assets between them without the need for a centralized exchange.

The features of bridges

These bridges differ in various aspects, including the technology used, the interoperability features, and the security protocols.

One of the primary ways that blockchain bridges differ from each other is the technology used to build them.

Some bridges use centralized technologies that rely on trusted third parties to facilitate transactions between blockchains.

On the other hand, other bridges use decentralized technologies that use smart contracts and other blockchain-based mechanisms to facilitate cross-chain transactions.

Blockchain bridges also differ in their interoperability features.

Some bridges allow for one-way communication, where tokens can be transferred from one blockchain to another but cannot be transferred back.

Other bridges allow for bidirectional communication, where tokens can be transferred between blockchains in both directions.

Additionally, some bridges offer advanced interoperability features, such as cross-chain smart contract execution, which allows for complex transactions between different blockchains.

Finally, blockchain bridges differ in their security protocols.

Bridges that use centralized technologies often rely on trusted third parties, which can pose a security risk if these parties are compromised.

In contrast, decentralized bridges that use smart contracts and other blockchain-based mechanisms often offer higher security and lower risk of hacking or other attacks.

What is special about pNetwork

pNetwork's unique features make it a valuable platform for those looking to transfer assets between different blockchain networks securely, quickly, and at a low cost.

- Decentralized: pNetwork is following a progressive decentralization approach and, with the upcoming v3, it will be a fully decentralized platform. This ensures that there is no single point of failure and makes the network more secure.

- Advanced Interoperability: when a user needs to transfer a bridged token to another destination chain (host chain), most bridges require it to go back to the native (or source) blockchain. pNetwork allows the direct transfer of a bridged token through different destination chains. This feature is called “pTokens to pTokens bridge” and allows the bridging of wrapped tokens between different host chains.

- Transparent: All transactions on pNetwork are transparent and publicly accessible on the blockchain, ensuring the integrity of the network.

- Low fees: pNetwork offers low transaction fees, making it more affordable for users to transfer assets across different blockchains. Specifically, protocol fees (0.1% pegin fee, 0.25% pegout fee) accrued by pNetwork are distributed to the pNetwork node operators and to the PNT lenders on pNetwork DAO v2 for their crucial service provided to pNetwork. Since the approval of PIP-26 (PGP-1), a $10 minimum protocol fee has been applied to both pegins and pegouts in all bridges. The network fee (gas price) may vary as it depends on the chosen network and its congestion.

- Fast transaction times: pNetwork's innovative architecture allows for fast transaction times, enabling users to transfer assets across different blockchains quickly and efficiently.

- Governance: pNetwork has a robust governance model that allows users to participate in the decision-making process and vote on proposals that affect the network.

How it works

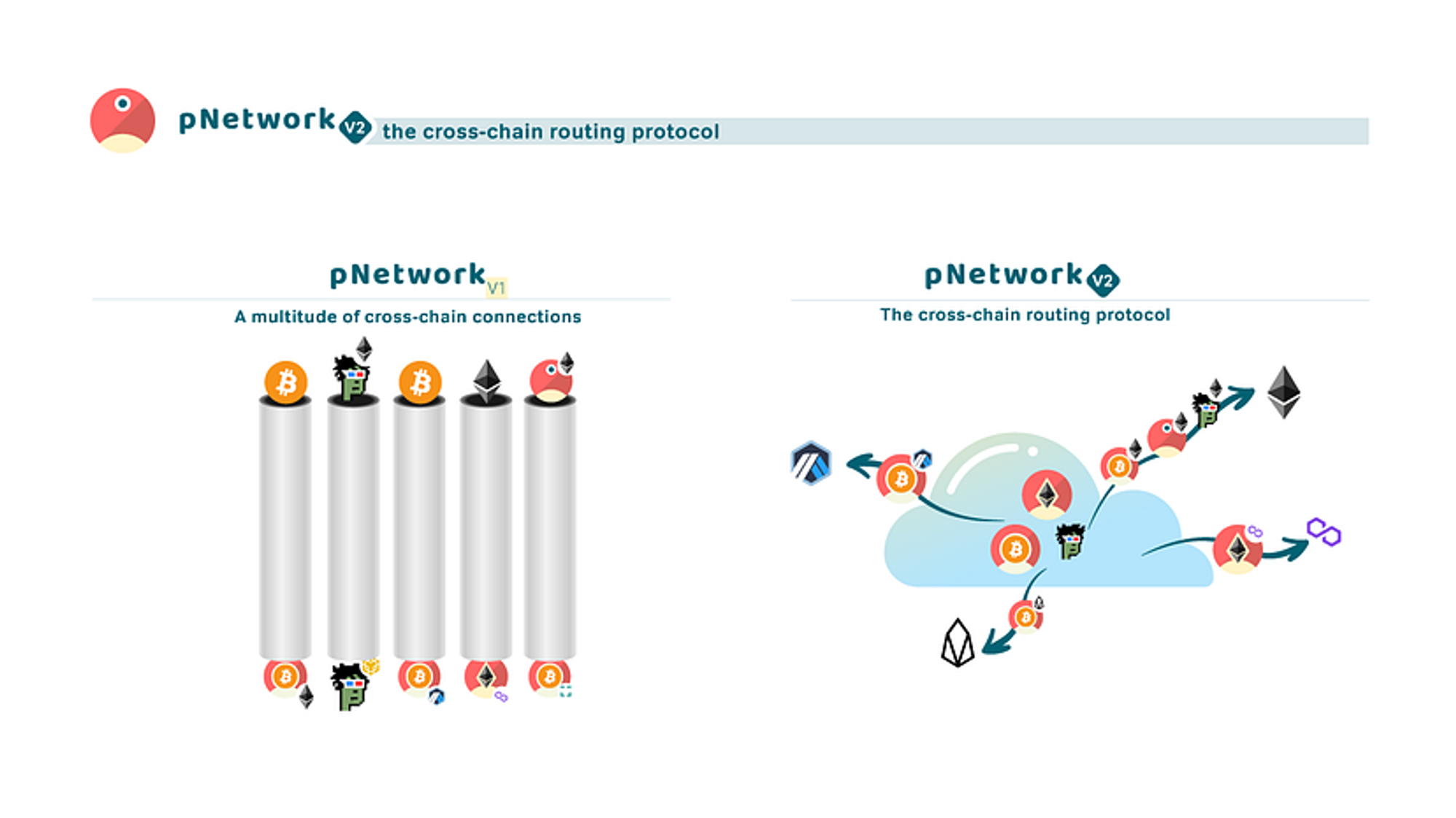

pNetwork v1 was launched in March 2020 in its simplest form, a pTokens bridge, to enable the cross-chain movement of Bitcoin on Ethereum. From there, it has evolved into a DAO-governed, progressively decentralized network of nodes that power the movement of tokenized assets such as wrapped Bitcoin across a multitude of ecosystems.

The current pNetwork v2, which was introduced in October 2021, transformed the protocol into an open-source protocol for cross-chain routing between blockchain ecosystems and scalability networks empowering cross-chain applications.

The v2 has enabled users and smart contracts on any blockchain platform to send and receive assets and data messages cross-chain, significantly improving and expanding the applicability of the previous version: that is, communications from any blockchain to any blockchain.

Transfer from Origin Chain to Host Chain (Pegin)

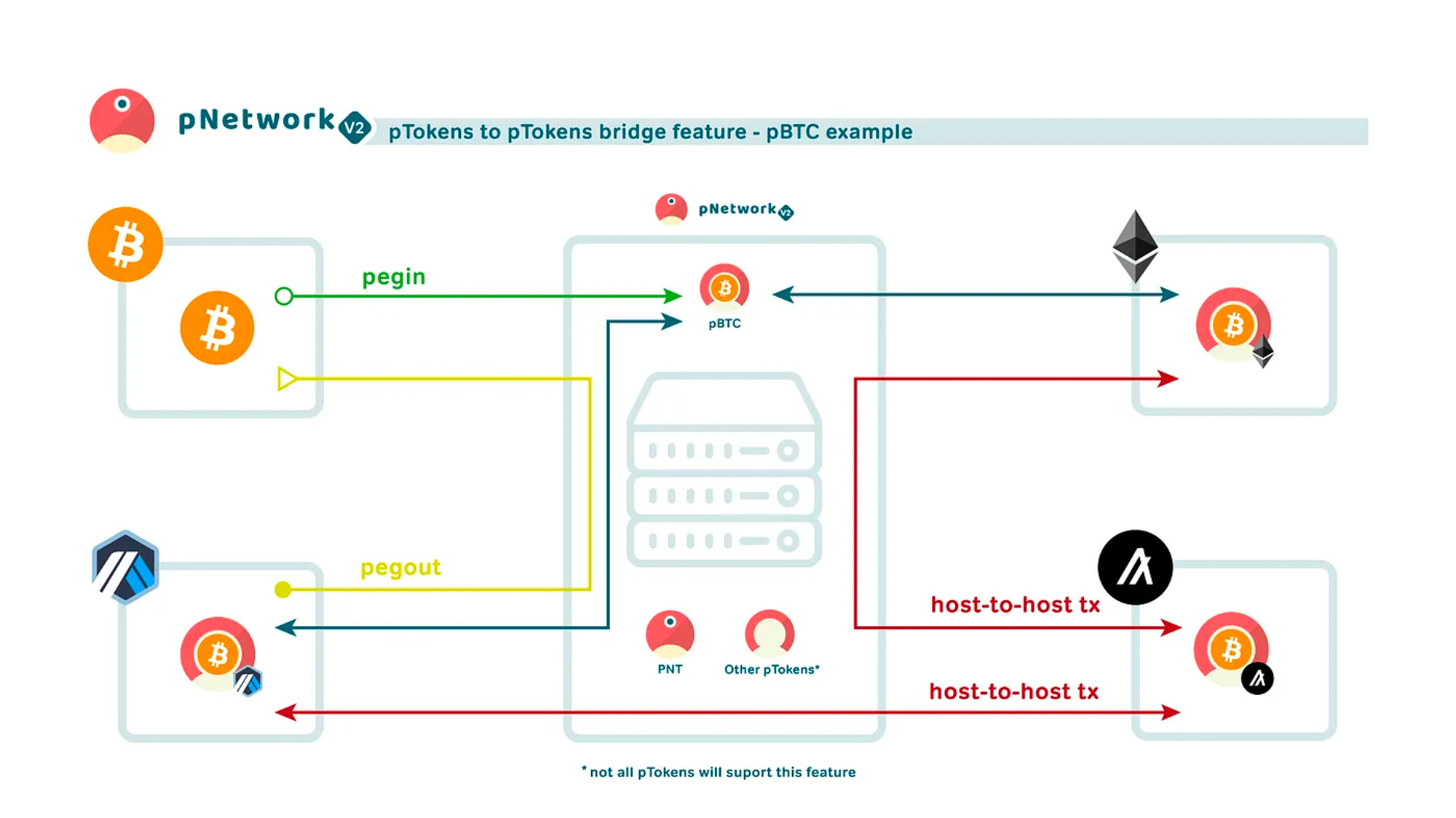

Each bridge is a link between two (or more) blockchains. On the asset origin chain, the asset to be bridged is sent to a special SMPC wallet address and held securely there. This is the pNetwork Vault.

On the destination chain, a smart contract mints pTokens in a 1:1 ratio with those held in the Vault and sends them to the user's wallet.

This process is referred to as “Pegin”.

Transfer from Host Chain to Origin Chain (Pegout / Redeem)

The “Pegout” or “Redeem” phase takes place when a user wants its assets back on the Origin Chain.

In this case, the user sends the pegged tokens back to pNetwork, and a contract burns them and automatically releases the original asset from the Vault back to the user’s address on the Origin Chain.

Transfer between two Host Chains - pTokens to pTokens bridge

The cross-chain routing protocol introduced by pNetwork v2 results in an evolution of pTokens bridges. The pTokens to pTokens bridge powers the seamless and cost-efficient transfer of liquidity from one ecosystem to another, including direct transitions from a host blockchain to another host blockchain, without passing by the origin chain.

That is, for example, the pTokens-version of wrapped Bitcoin on Ethereum can be efficiently moved directly from Ethereum to Arbitrum to Binance Smart Chain to Polygon without the need to ever go back to the Bitcoin blockchain.

This feature is called pTokens to pTokens bridge and more information can be found here.

Currently available for BTC and PNT, the feature can be enabled for any v2-powered asset, including stablecoins and project-tokens looking to expand their reach. In order to be eligible, a pToken needs to be integrated on at least two host blockchains and its bridges need to be supported by pNetwork v2.

Protocol profitability

Currently, the pNetwork protocol earns revenue through fees from cross-chain operations. These fees are regularly distributed to pNetwork nodes in the currencies that were bridged cross-chain, including BTC, PNT and other pTokens.

The current fee model for pNetwork is set at 0.1% pegin fees and 0.25% pegout fees. While some bridges currently employ a no-fee model, the pNetwork protocol has successfully implemented a fee model on cross-chain transactions.

Since the approval of PIP-26 (PGP-1), a $10 minimum protocol fee has been applied for both pegins and pegouts in all bridges.

The cross-chain volumes processed by pNetwork have exceeded $1 billion and, at their peak, resulted in monthly fees of approximately $180,000.

The updated total amount of protocol fees generated and distributed to the nodes are:

Cross-chain volumes processed are a vital metric for determining the profitability of the protocol, the profitability of pNetwork nodes (PNT holders), and the future auto-financing of the project.